Mera Ghar Mera Ashiana Scheme

Owning a home is every Pakistani’s dream — a place of comfort, safety, and belonging. In today’s world, when construction costs and housing prices are constantly rising, the Mera Ghar Mera Ashiana scheme has become a beacon of hope for families who wish to own a home despite limited income.

The Bank of Punjab (BOP) introduced this scheme to help ordinary citizens buy, build, or renovate homes through affordable installment plans.

This initiative supports the Government of Pakistan’s vision of providing financial assistance to low- and middle-income families so that no one is left without a roof over their head.

If you’ve been wondering when your dream home will finally become a reality, this guide will explain how Mera Ghar Mera Ashiana can open the door to your own house.

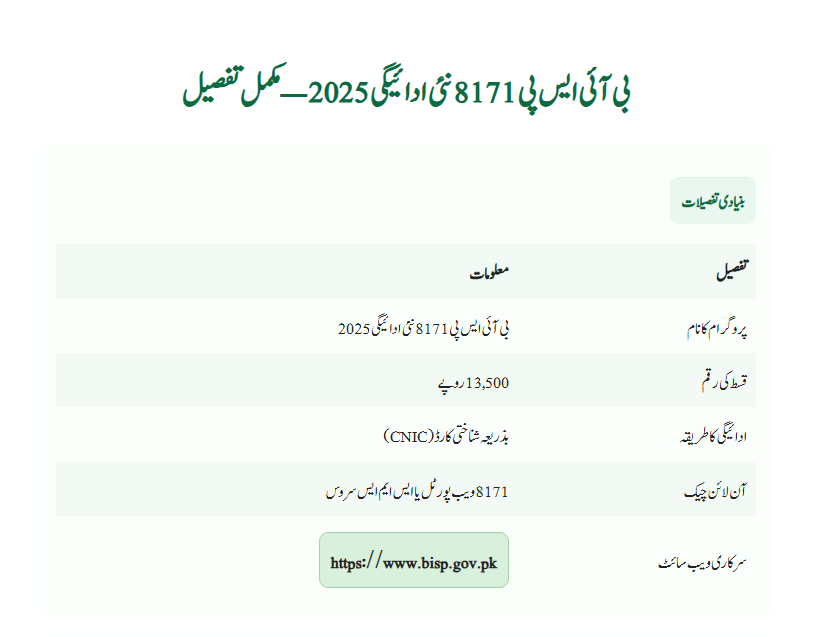

Quick Details

| Detail | Information |

|---|---|

| Scheme Name | Mera Ghar Mera Ashiana (Bank of Punjab) |

| Bank | Bank of Punjab |

| Loan Types | Purchase, Construction, Renovation, Refinance |

| Loan Tenure | 5 to 25 years |

| Official Website | https://www.bop.com.pk |

What Is the Mera Ghar Mera Ashiana Scheme?

The Mera Ghar Mera Ashiana scheme by the Bank of Punjab is a comprehensive home finance program that allows individuals to buy, construct, or renovate their homes on easy terms.

It helps turn your income into manageable monthly installments so you can fulfill your dream of owning a house with confidence.

The scheme includes several financing options:

- Home Purchase Loan: For buying a ready house or apartment.

- Home Construction Loan: For building a new house on your own land.

- Home Improvement Loan: For renovating or expanding your existing home.

- Refinance / Balance Transfer: To transfer your current home loan to the Bank of Punjab for better rates and terms.

Who Is Eligible for Mera Ghar Mera Ashiana?

| Category | Details |

|---|---|

| Age Limit | Minimum 21 years; maximum 65 years (depending on employment type) |

| Nationality | Pakistani citizens and Non-Resident Pakistanis (NRPs) |

| Income Source | Verifiable salaried or business income |

| Credit Record | Clean and consistent credit history |

| Collateral | The financed property is usually mortgaged with the bank |

If you have a stable job or a verified business, you’re likely to qualify easily for this scheme.

What Documents Are Required for Mera Ghar Mera Ashiana?

Before applying, make sure you prepare all necessary documents to avoid delays:

- CNIC or NICOP (for NRPs)

- Two recent passport-size photos

- Salary slips (last 3–6 months)

- Bank statements (last 6–12 months)

- Property documents or sale agreement

- Electricity or gas bill (as proof of address)

- Proof of down payment

- Business registration and tax returns (for self-employed applicants)

How to Apply for Mera Ghar Mera Ashiana — Step by Step

- Choose the Right Loan Type

Decide whether you want a loan for buying, building, or renovating a home. - Get Pre-Qualification

Visit your nearest Bank of Punjab branch or apply online through the official website. - Prepare All Documents

Gather and organize all documents neatly for faster processing. - Submit the Application

Submit your completed form along with the required processing fee and keep your receipt. - Verification and Property Valuation

The bank will verify your income, employment, and property ownership details. - Approval and Offer Letter

Once approved, you’ll receive an offer letter outlining your loan amount, interest rate, tenure, and terms. - Legal Documentation and Loan Disbursement

After signing the agreement and completing legal formalities, the loan is disbursed either in full or in stages, depending on the loan type.

Mera Ghar Mera Ashiana Processing Timeline

| Step | Estimated Time |

|---|---|

| Pre-qualification | 1–3 days |

| Document preparation | 3–10 days |

| Credit and property checks | 2–4 weeks |

| Final disbursement | 1–3 weeks |

On average, the complete process takes 3 to 8 weeks from start to finish.

What Are the Interest Rates and Fees for Mera Ghar Mera Ashiana?

- Interest rates vary based on market conditions and loan type.

- Loan tenure ranges from 5 to 25 years.

- Fees include processing, valuation, legal charges, and stamp duty.

Example:

If you take a loan of PKR 3,000,000 at a 14% annual rate, your approximate monthly installment will be PKR 39,000–43,000.

Use the official Bank of Punjab EMI Calculator for accurate figures.

How to Increase Your Chances of Loan Approval?

- Maintain a good credit record by paying bills and loans on time.

- Submit complete and transparent financial information.

- Make a higher down payment if possible.

- Add a co-applicant with stable income.

- Ensure your property documents are clear and legally verified.

- Disclose any previous credit issues honestly.

Frequently Asked Questions (FAQs)

1. Can Non-Resident Pakistanis apply for Mera Ghar Mera Ashiana?

Yes, NRPs can apply by providing a valid passport, proof of overseas income, and remittance details.

2. Is any government subsidy available under this scheme?

In some cases, applicants may qualify for housing subsidies. Confirm with the Bank of Punjab branch for details.

3. What happens if I miss a monthly installment (EMI)?

Late payments can result in penalties and affect your credit score. Contact the bank immediately to discuss rescheduling options.

4. Can I repay my loan early?

Yes, early repayment is allowed, but check your offer letter for prepayment terms and possible charges.

5. Is this scheme only for urban properties?

No, the Bank of Punjab provides home finance for both urban and rural properties, provided all legal documents are complete.

Conclusion

The Mera Ghar Mera Ashiana scheme by the Bank of Punjab is a reliable opportunity for thousands of Pakistanis who dream of owning their own homes.

This program not only makes housing finance more affordable but also provides a dignified path toward homeownership.

With proper planning, complete documentation, and clear understanding of the process, you can finally turn your dream of Mera Ghar, Mera Ashiana into reality.