Every year after the national budget, Pakistanis start asking: “Will we be paying more taxes this time?” In 2025, one of the most discussed changes is the ATM Cash Withdrawal Tax Pakistan 2025, which sets new rates and limits for cash withdrawals.

The government says it’s a step toward financial transparency and a stronger economy — but how will it really affect everyday citizens? Will it push more people to become tax filers, or just make life harder for non-filers?

Let’s break down everything you need to know in simple terms.

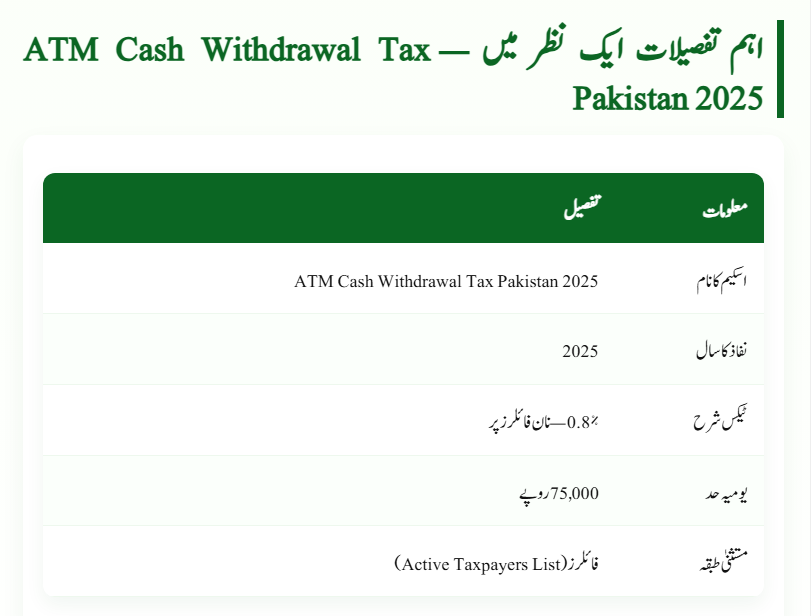

Quick Details

| Category | Details |

| Scheme Name | ATM Cash Withdrawal Tax Pakistan 2025 |

| Effective Year | 2025 |

| Tax Rate | 0.8% for Non-filers |

| Daily Limit | Rs. 75,000 |

| Exemption | Filers (Active Taxpayers List) |

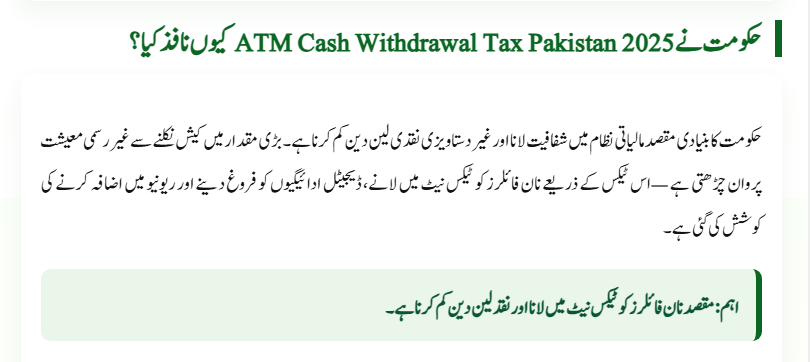

Why Did the Government Introduce the ATM Cash Withdrawal Tax Pakistan 2025?

The government launched this tax to make Pakistan’s financial system more transparent and to reduce untracked cash movement.

For years, large sums were being withdrawn in cash, fueling the undocumented economy.

Now, with this policy, the government aims to:

- Bring non-filers into the tax system.

- Promote digital and traceable banking transactions.

- Increase national tax revenue through compliance.

Experts say that if applied correctly, this move could make Pakistan’s financial system more disciplined and reduce money laundering risks.

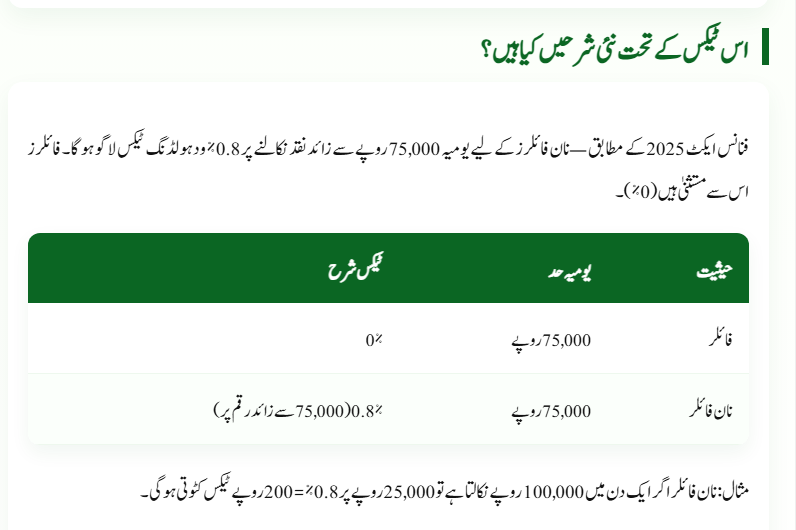

What Are the New Tax Rates Under ATM Cash Withdrawal Tax Pakistan 2025?

According to the Finance Act 2025, non-filers will now pay a 0.8% withholding tax on daily cash withdrawals exceeding Rs. 75,000.

Previously, the rate was 0.6% and the limit was Rs. 50,000.

| Status | Daily Limit | Tax Rate | Who Pays |

| Filer | Rs. 75,000 | 0% | No tax applied |

| Non-Filer | Rs. 75,000 | 0.8% | Applied on the amount exceeding Rs. 75,000 |

Example:

If a non-filer withdraws Rs. 100,000 in one day → taxable amount = 25,000 → 0.8% of 25,000 = Rs. 200.

Filers, however, pay no tax on withdrawals under this rule.

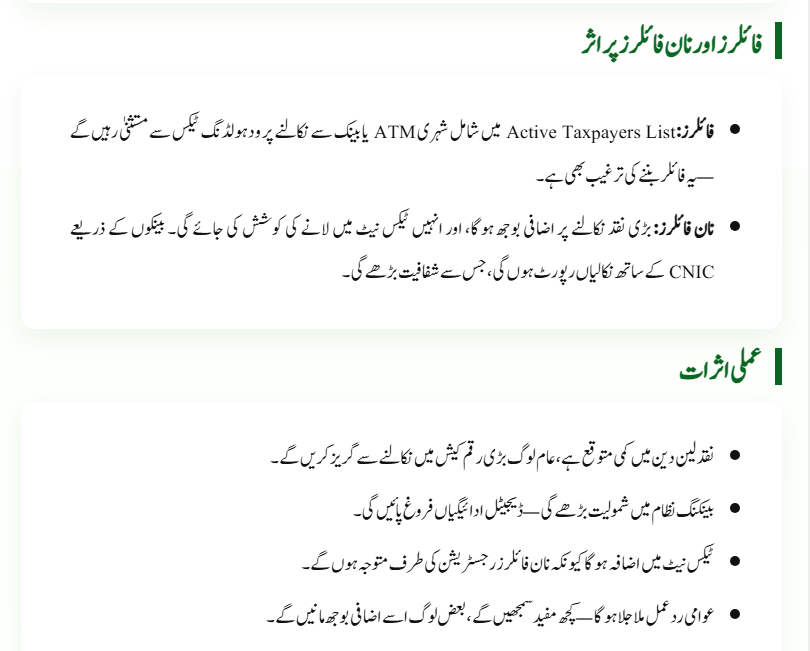

What Does It Mean for Filers and Non-Filers?

For Filers:

Those who are registered on the FBR Active Taxpayers List (ATL) are completely exempt from this tax.

This is a reward for taxpayers and an incentive for others to become filers.

For Non-Filers:

Every large withdrawal now comes with a cost.

Banks report all withdrawals through CNICs, so cash flow can be tracked.

The system reduces anonymity and encourages registration in the formal economy.

What Are the Real-Life Impacts of ATM Cash Withdrawal Tax Pakistan 2025?

- Reduced cash transactions: People will withdraw less cash to avoid the extra cost.

- More digital payments: Citizens will use online banking, debit cards, or e-wallets more often.

- Higher tax compliance: Non-filers will feel pressure to register with FBR.

- Public reaction: Mixed — some support it for transparency, others see it as another burden.

In short, it’s a financial nudge to move Pakistan toward a cashless, documented economy.

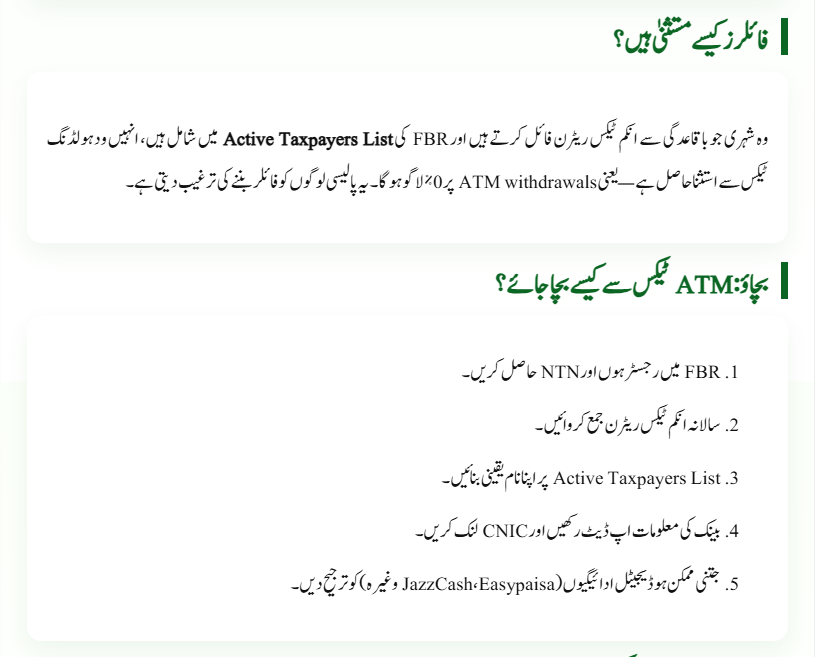

How Can Filers Stay Exempt from ATM Cash Withdrawal Tax Pakistan 2025?

The government has clearly stated that anyone listed in the Active Taxpayers List (ATL) will not pay this tax.

To remain exempt, citizens must:

- File their annual income tax returns on time.

- Make sure their name appears on the FBR ATL.

- Keep bank and CNIC details updated.

This ensures smooth, tax-free transactions at all banks and ATMs.

How Can You Avoid Paying This Tax as a Non-Filer?

If you’re not a filer yet, here’s what you can do to avoid the ATM Cash Withdrawal Tax Pakistan 2025:

- Register with FBR and get your NTN (National Tax Number).

- Submit your annual tax return.

- Ensure your name is listed on the Active Taxpayers List (ATL).

- Keep your bank information updated.

- Use digital payment methods like Easypaisa, JazzCash, or online transfers when possible.

These steps not only save you money but also make you a part of Pakistan’s formal economy.

ATM Tax vs Bank Service Charges — What’s the Difference?

Many people confuse the government’s withholding tax with bank service charges, but they’re totally different:

| Type | Description |

| Withholding Tax | A government-imposed tax on cash withdrawals by non-filers. |

| ATM Service Charges | Fees charged by banks for using another bank’s ATM or certain services. |

So, yes — non-filers may face both, but filers only pay the bank’s usual fees (not the tax).

Why Did the Government Make This Move?

Here are the main reasons behind this change:

- To bring non-filers into the tax network.

- To monitor large, unrecorded cash flows.

- To strengthen financial transparency.

- To track real income through banking data.

- To generate stable revenue for the national budget.

According to economic experts, if enforced fairly, this could help Pakistan reduce financial corruption and promote a healthier banking system.

Frequently Asked Questions (FAQs)

1. What is the ATM cash withdrawal tax rate in Pakistan 2025?

It’s 0.8% for non-filers on daily withdrawals exceeding Rs. 75,000. Filers are completely exempt.

2. Are multiple withdrawals in one day added together?

Yes. All ATM and branch withdrawals in a single day are combined before applying the Rs. 75,000 threshold.

3. What was the previous limit?

Earlier, it was Rs. 50,000. The government raised it to Rs. 75,000 in 2025.

4. Are ATM service fees and this tax the same thing?

No. Bank fees are separate — this tax is imposed by the government only on non-filers.

5. How can non-filers avoid this tax?

By registering with the FBR, filing tax returns, and becoming part of the Active Taxpayers List (ATL).

Conclusion

The ATM Cash Withdrawal Tax Pakistan 2025 is a major policy move aimed at promoting transparency, reducing cash dependency, and bringing more citizens into the tax system. While non-filers might see it as an extra cost, it actually encourages financial responsibility and a more transparent economy.

The message from the government is clear:

“If you’re a filer, you save. If not — it’s time to become one.”

For official information, visit:

👉 www.fbr.gov.pk