The Khushhali Apna Makaan Scheme 2025 is a housing economics initiative by Khushhali Microfinance Bank (KMBL) to help middle and lower middle classes own or advance homes. Under this arrangement, you can get a home-based loan up to Rs. 35 lakh with a low hike rate preliminary from 5% to 8%. This guide will walk you through suitability, request steps, repayment, pros & cons, and real examples — so you don’t have to search away.

| Field | Information |

|---|---|

| Scheme Name | Khushhali Apna Makaan Scheme 2025 |

| Launch / Announcement | 2025 (recent promotion) |

| Maximum Loan Amount | Up to Rs. 35 lakh (PKR 3,500,000) |

| Markup Rate | From 5% to 8% (depending on income / profile) |

| Loan Tenure | Up to 20 years |

| Application Method | Through Khushhali Bank branch (offline) |

| Purpose | Buy, build, or renovate home |

| Collateral | The property being financed / mortgage |

What Is the Khushhali Apna Makaan Scheme?

Khushhali’s “Apna Makaan” is a micro-housing / affordable home loan product. It is designed especially for:

- Salaried individuals (public/private sector)

- Self-employed professionals, shopkeepers, freelancers

- Small business people who want to invest in a home

This scheme lowers the barrier for home ownership by offering longer tenures, lower markup, and temperately simpler guarantee related to old-style set cover loans.

Khushhali already markets their “Apna Makaan” product as a micro-housing loan for building, renovation, or purchase.

Key Features & Highlights

- Loan limit: Up to Rs. 35 lakh for eligible applicants.

- Markup / interest: Ranges around 5% to 8% depending on your income, risk profile, and property.

- Tenure: You may repay over periods up to 20 years.

- Eligible purposes: Purchase, construction, or renovation of homes.

- Collateral / property security: Usually, the property being financed must be used as security, with mortgage or title held by the bank.

- Processing time: Around 15 to 30 working days, depending on documentation and valuation.

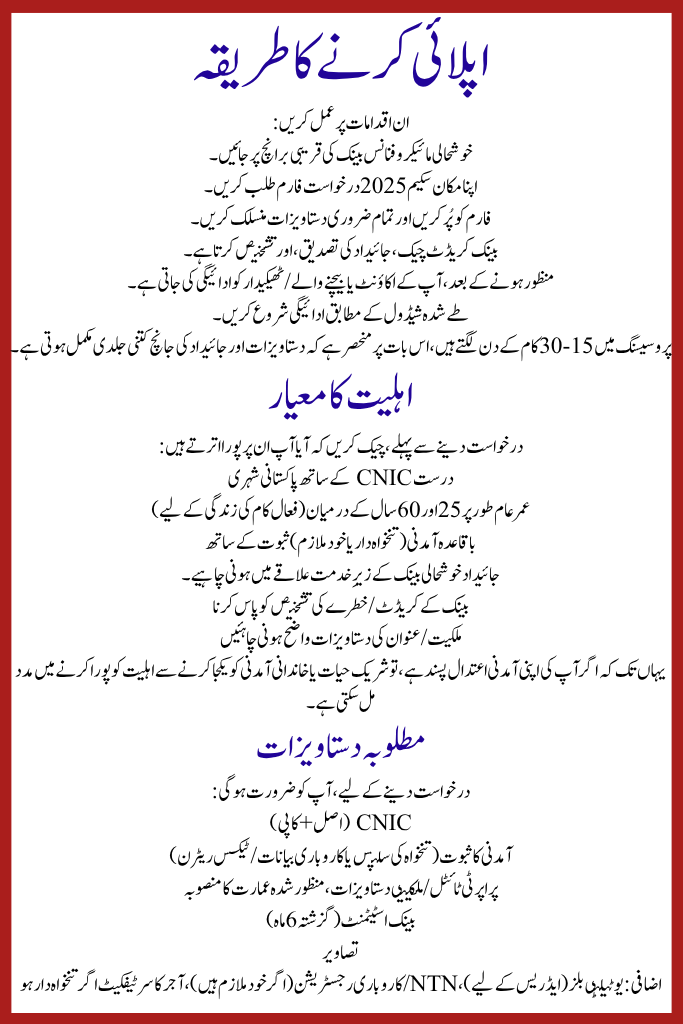

Eligibility Criteria

Before applying, check if you meet these:

- Pakistani citizen with valid CNIC

- Age typically between 25 and 60 years (for active work life)

- Regular income (salaried or self-employed) with proof

- Property must be in an area served by Khushhali Bank

- Passing the bank’s credit / risk evaluation

- Ownership / title documentation must be clear

Even if your own income is moderate, combining spouse or family income may help meet eligibility.

Types of Loans Under Apna Makaan

The scheme offers different variants depending on your need:

- Home Construction Loan: If you own land and wish to build your house

- Home Purchase Loan: Buying a house from builder / seller

- Home Renovation / Extension Loan: Repairing, expanding, or upgrading existing property

Each type may have slightly different markup, tenure, or documentation rules based on risk and cost.

Required Documents

To apply, you’ll need:

- CNIC (original + copy)

- Income proof (salary slips or business statements / tax returns)

- Property title / ownership documents, approved building plan

- Bank statements (last 6 months)

- Photographs

- Additional: Utility bills (for address), NTN / business registration (if self-employed), employer certificate if salaried

How to Apply

Follow these steps:

- Visit the nearest Khushhali Microfinance Bank branch

- Ask for Apna Makaan Scheme 2025 application form

- Fill out the form and attach all needed documents

- The bank does credit check, property verification, and valuation

- Once approved, disbursement is made either to your account or seller / contractor

- Begin repayment as per agreed schedule

Processing tends to take 15–30 working days, depending on how quickly documents and property evaluation are completed.

Example of Installment (Estimated)

Here’s a ballpark estimate of monthly payments based on typical markup and tenure:

| Loan Amount | Tenure | Markup | Approx. Monthly Installment |

|---|---|---|---|

| Rs. 10 lakh | 10 years | ~5% | ~ Rs. 10,600 |

| Rs. 20 lakh | 15 years | ~6% | ~ Rs. 17,000 |

| Rs. 35 lakh | 20 years | ~8% | ~ Rs. 29,400 |

Note: These are estimates. Your actual installment may vary based on property value, bank risk profile, and exact terms.

Benefits & Possible Drawbacks

Benefits

- Low markup compared to typical housing finance

- Long repayment period makes monthly burden lighter

- Helps middle & lower income groups access housing finance

- Multiple purposes: buy, build, renovate

- Simpler documentation compared to large conventional bank loans

Drawbacks / Things to Consider

- Must provide property as collateral — risk of losing property if default

- Not all areas may be enclosed (bank branch reach matters)

- Approval depends heavily on property valuation and credit score

- The higher markup (e.g. 8%) will increase price for bigger or longer-term loans

- The scheme may have limits on all-out loan vs property value

Comparison: Apna Makaan vs Other Home Finance Options

| Feature | Khushhali Apna Makaan | Standard Commercial Housing Loan |

|---|---|---|

| Markup / Interest | 5% to 8% | Often much higher |

| Tenure | Up to 20 years | Usually shorter or similar |

| Collateral / Security | Property being financed | Same or stricter |

| Documentation | More relaxed / micro housing model | More demanding |

| Target Audience | Middle / lower income | Broader market including high end |

If you prefer Islamic / Shariah financing, you might compare with schemes like Meezan’s home finance or Mera Ghar Mera Ashiana by other banks. (See Mera Ghar – Mera Ashiana, also offered by Khushhali, with subsidized markup rates)

Final Thoughts & Advice

The Khushhali Apna Makaan Scheme 2025 offers a talented route for many Pakistanis who dream of possessing or refining a home. With lower rise, flexible tenancy, and comparatively humbler process, it’s a good choice — but be sure:

- To verify branch contribution in your area

- To get full cost breakdown (markup + any fees) in script

- To ensure your documents and property title are clean

- To compare with rival systems (Islamic finance, administration cover plans)