The Administration of Punjab has threw Phase 2 of the Asaan Karobar Card / Finance Scheme 2025 to provision small and medium enterprises (SMEs) with reasonable credit. The idea: help entrepreneurs grow, update, and scale using a card-based, digital, see-through loan model.

Punjab Asaan Karobar Card Scheme Phase 2

| Field | Details |

|---|---|

| Name of Program | Punjab Asaan Karobar Card / Finance Scheme Phase 2 |

| Start Date | Expected Q4 2025 (announcement in September 2025) |

| End / Duration | Rolling / until target funds exhausted (until 2026 target) |

| Amount of Assistance (max) | Up to PKR 1,000,000 (1 million) per business |

| Interest / Markup | 0% mark-up / interest-free, subsidized by the government |

| Method of Application | Online / Digital, via Punjab SME portal & BOP systems |

What is the Asaan Karobar Card / Finance Scheme?

The CM Punjab Asaan Karobar Card (also called Asaan Karobar Finance) is a prize database run in collaboration between Punjab Small Industries Corporation (PSIC) and Bank of Punjab (BOP). Its aim is to provide small and medium business owners easy access to coffers, with digital following, transparency, and accountability built in.

Under this scheme, eligible entrepreneurs can copy up to PKR 1 million (10 lakh) for commercial use — buying machinery, renovating shops, buying stocks, disbursing suppliers, etc. The card-based model ensures each transaction is traceable: biometric checks, SMS warnings, and a PITB (Punjab Info Technology Board) dashboard screen the flow of funds.

During Phase 1, over 104,133 SMEs established support and PKR 41.17 billion was paid. The recovery / repayment rate was around 96%, which is considered a major success. (These numbers stood cited in Phase 1 announcements.)

Because of that achievement, the administration decided to enlarge the scheme in Phase 2 to more conurbations and increase its reach.

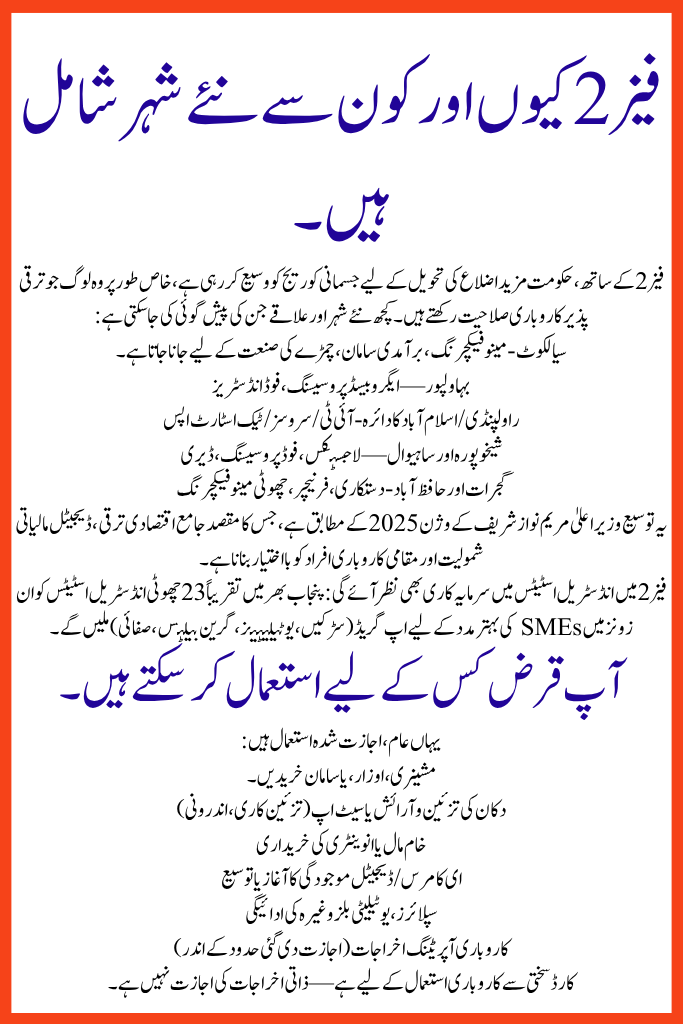

Why Phase 2 and Which New Cities Are Included

With Punjab Asaan Karobar Card Scheme Phase 2, the government is broadening physical coverage to custody more districts, specially those with developing business potential. Some of the novel cities and regions predictable to be included:

- Sialkot — known for manufacturing, export goods, leather industry

- Bahawalpur — agro-based processing, food industries

- Rawalpindi / Islamabad periphery — IT / services / tech startups

- Sheikhupura & Sahiwal — logistics, food processing, dairy

- Gujrat & Hafizabad — crafts, furniture, small manufacturing

This expansion aligns with Chief Minister Maryam Nawaz Sharif’s Vision 2025, which aims for inclusive economic growth, digital financial inclusion, and empowering local entrepreneurs.

Phase 2 will also see investment in industrial estates: about 23 small industrial estates across Punjab will get upgrades (roads, utilities, green belts, cleanliness) to better support SMEs in those zones.

Achievements & Lessons from Phase 1

Phase 1 of Asaan Karobar proved many things:

- Over 104,133 businesses were financed.

- Disbursement totaled PKR 41.17 billion (≈ Rs. 41.17 B).

- Recovery rate was 96%, meaning the vast majority of borrowers repaid as expected.

- A large proportion were first-time entrepreneurs.

- Digital transaction tracking and oversight reduced corruption and misuse.

These outcomes built confidence, showing that when credit is accessible and properly monitored, SMEs can thrive rather than default.

How Phase 2 Will Work: Roles & Mechanisms

Role of Bank of Punjab (BOP) & PSIC

- BOP will manage all disbursements, repayments, vendor payments, and interface with the card system.

- PSIC will coordinate the SME support side: outreach, verification, working with local industries.

- PITB will maintain the digital dashboard, linking data from BOP, NADRA, and other systems.

Digital Application, Verification & Monitoring

- Applicants apply online via the official Punjab Asaan Karobar portal, submit CNIC, business proof, etc.

- Biometric confirmation (via NADRA) confirms identity.

- The system also verifies business existence, credit history, etc.

- Every disbursement and vendor payment is tracked in real time.

- SMS / mobile alerts notify interviewees about status or required movements.

- Dashboard for administration treatment ensures slide

Disbursement Timing

From approval, businesspersons may get funds inside 10–15 working days (target) — subject to text checks and verification. (This is the administration’s predictable goal; actual judgment may vary founded on assignment and authorization delays.)

What You Can Use The Loan For

Here are common, permitted uses:

- Buy machinery, tools, or equipment

- Shop refurbishment or setup (renovation, interiors)

- Raw material or inventory purchase

- Launching or expanding e-commerce / digital presence

- Paying suppliers, utility bills, etc.

- Business operating expenses (within permitted limits)

The card is strictly for business use — personal expenses are not allowed.

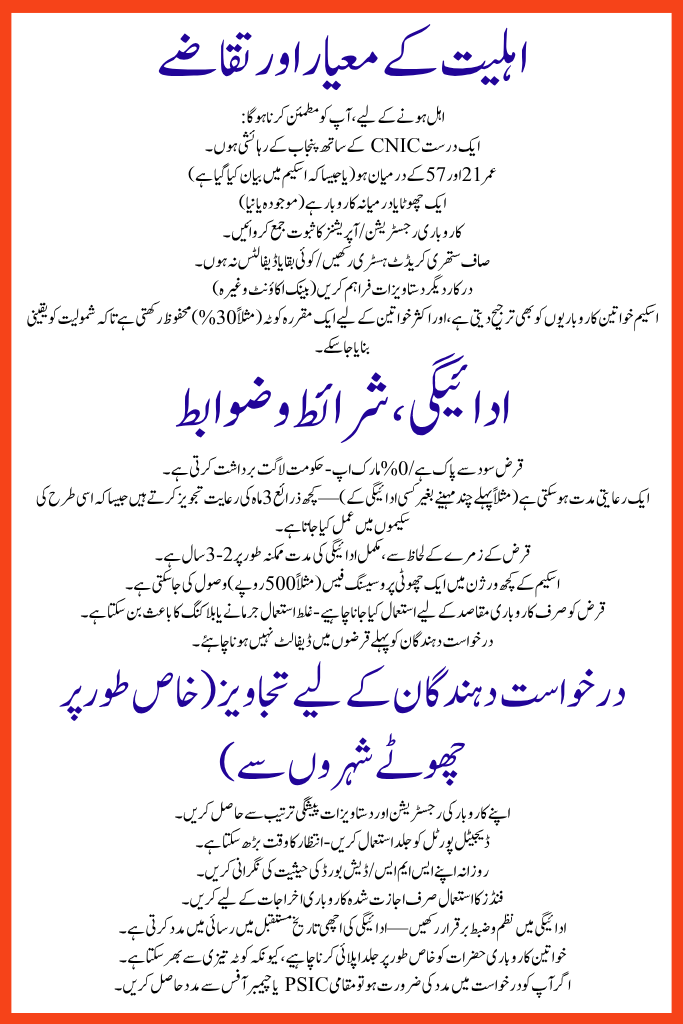

Eligibility Criteria & Requirements

To be eligible Punjab Asaan Karobar Card Scheme Phase 2, you must satisfy:

- Be a resident of Punjab with a valid CNIC

- Be between age 21 and 57 (or as defined in scheme)

- Have a small or medium business (existing or new)

- Submit proof of business registration / operations

- Have a clean credit history / no outstanding defaults

- Provide any other documents required (bank account, etc.)

The scheme also gives priority to women entrepreneurs, and often reserves a fixed quota (e.g. ~30%) for women to ensure inclusion.

Repayment, Terms & Conditions

- The loan is interest-free / 0% mark-up — the government bears the cost.

- There may be a grace period (e.g. first few months with no payments) — some sources suggest a 3-month grace as practiced in similar schemes.

- The full repayment period is likely 2–3 years, depending on loan category.

- A small processing fee may be charged (e.g. Rs. 500) in some versions of the scheme.

- The loan must be used only for business purposes — misuse may lead to penalties or blocking.

- Applicants must not have defaulted on loans previously.

Expected Impact & Goals of Phase 2

The Punjab Asaan Karobar Card Scheme Phase 2 government has set ambitious targets:

- Serve ~200,000 entrepreneurs by 2026

- Disburse PKR 60+ billion in financing under Phase 2

- Generate 150,000+ new jobs across the province

- Increase female entrepreneurship share significantly

- Strengthen Punjab’s SME sector, boost GDP, reduce unemployment

If successful, Punjab Asaan Karobar Card Scheme Phase 2 will amplify economic inclusion beyond big cities and reach smaller districts.

Tips for Applicants (especially from smaller cities)

- Get your business registration and documentation in order in advance

- Use the digital portal early — wait times may increase

- Monitor your SMS / dashboard status daily

- Use the funds only for allowed business expenses

- Maintain discipline in repayment — good repayment history helps future access

- Women entrepreneurs should particularly apply early, as quotas may fill fast

- Seek support from local PSIC or chamber offices if you need help with application

(FAQs)- Punjab Asaan Karobar Card Scheme Phase 2

What is the maximum loan amount?

Up to PKR 1,000,000 (1 million) under Phase 2.

Is interest charged?

No — it is interest-free / 0% mark-up.

How to apply?

Via the official online portal of Punjab (Asaan Karobar Finance / Card) and BOP’s interfaced system.

Which cities are included in Phase 2?

New additions include Sialkot, Bahawalpur, Rawalpindi / Islamabad periphery, Sheikhupura, Sahiwal, Gujrat, Hafizabad etc.

What happens if I miss an installment?

Penalties or restrictions may apply. Best to repay on time to maintain good standing.

Is partial cash withdrawal allowed?

In many card schemes, a portion (e.g. 25%) of coffers can be withdrawn in cash; the rest obligation be used numerically. (Check final arrangement rules.)

Conclusion

Punjab Asaan Karobar Card Scheme Phase 2 is a milestone move to empower minor and average businesses across Punjab — particularly in emerging cities. With PKR 1 million interest-free credit, digital transparency, and focus on inclusion (especially for women), this arrangement could convert the way entrepreneurs access finance.

Because of the high success and retrieval in Phase 1 (96% payment), the administration is confident that Phase 2 will scale even further. If you are running or preparation a business in Punjab, this is a golden chance — prepare your documents and apply early.